O’Neal Webster, a well-established British Virgin Islands law firm with offices in Tortola and London, is organized for the efficient delivery of legal services for our clients throughout the world. Our dedication to professional standards frames our business savvy approach and contributes to our clients’ successes. We stand by our client service promise and welcome your enquiry.

Search for Professionals or Topics

News & Announcements

BVI Merchant Shipping Act Limitation Claims: What you should know

Limitation of liability in the BVI Merchant Shipping Act is a legal mechanism that allows a shipowner (or other entitled party) to cap their total financial exposure to maritime claims at a maximum amount, regardless of the actual value of the claims. It applies to claims arising from collisions, cargo damage, personal injury, loss of life, delay, wreck removal and other incidents.

Limitation claims play a vital role in protecting shipowners and other parties from disproportionate liability arising in maritime and commercial contexts. Learn more >>>

Benefits Abound: Unregulated BVI Segregated Portfolio Companies for Investors and Family Offices

For investors and family offices operating internationally, managing risk while keeping structures simple is a challenge. The British Virgin Islands (BVI) offers a well-established solution: segregated portfolio companies (SPCs).

An SPC is a single company that can be divided into multiple legally protected portfolios, each of which can hold its own investments, contracts and liabilities separately.

What makes the BVI SPC particularly attractive is that this separation is set out in law rather than based solely on internal accounting, contractual arrangements or constitutional documents.

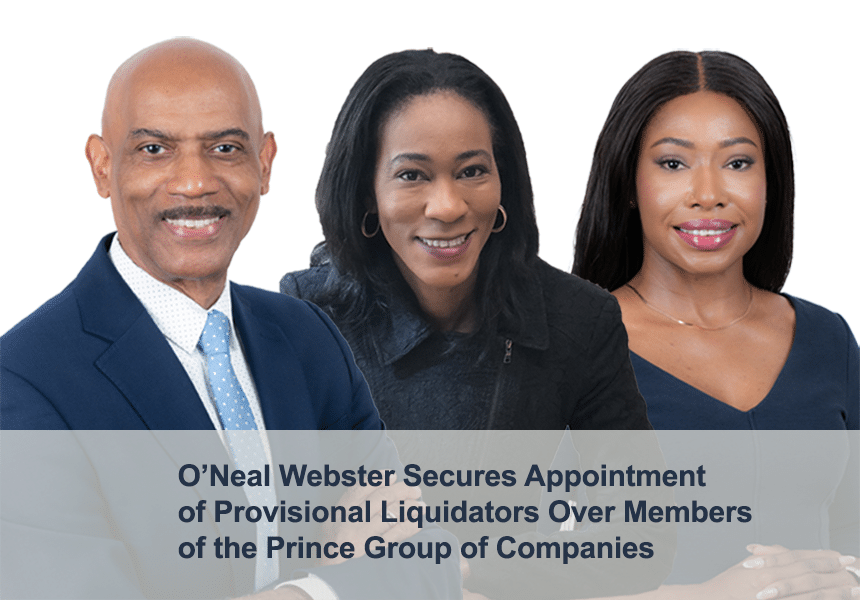

O’Neal Webster Secures Appointment of Provisional Liquidators Over Members of The Prince Group of Companies

In January 2025, the O’Neal Webster team of Paul Dennis, K.C., Nadine Whyte Laing and Koya Ryan successfully applied on behalf of the Attorney General of the Virgin Islands, for the appointment of joint provisional liquidators over 30 BVI registered companies, alleged to be involved in a transnational criminal organization headed by The Prince Group, a Cambodian corporate conglomerate that includes companies incorporated in the BVI, the Cayman Islands, Singapore, Hong Kong, and Taiwan.

Cambodian national, Chen Zhi, is alleged to be the chairman and mastermind of The Prince Group which, together with Chen himself, has been the target of a variety of coordinated enforcement actions in multiple jurisdictions, including the United Kingdom, the United States, Hong Kong, Singapore, Taiwan, Thailand and Cambodia. LEARN MORE >>>

BVI FSC updates statutory filing requirements – extension granted to certain companies and limited partnerships

The BVI Financial Services Commission has as of December 24, 2025 approved an extension of the period during which existing entities formed prior to January 2, 2025 may file non-public Registers of Members (ROM), Registers of General Partners (ROGP), Registers of Limited Partners (ROLP), and Beneficial Ownership (BO) information, without filing fees and penalties, until March 31, 2026. The previous deadline was December 31, 2025.

This extension does not amend the statutory transitional filing deadline of December 31, 2025, but represents only a deferral of the enforcement of penalties and a temporary suspension of filing fees for a period of three months.

Entities that have not filed the requisite information will have their status reflected as “in penalty” and therefore cannot make other filings or obtain a certificate of good standing, which is essential for some business activities. Therefore, although no penalties will be charged, it is best that any affected entity regularize their status as soon as possible by making any outstanding statutory filings.

Entities should be aware that filing fees and late filing penalties for ROM, ROGP, ROLP, and BO will be reinstated from April 1, 2026.

Entities are therefore advised to consult their registered agent or your usual O’Neal Webster lawyer as soon as possible if they are affected by the foregoing.

Congratulations to the Winners and Participants of Fin$mart 2026 Faceoff

Please join us in congratulating the prize winning schools and all the competitors who participated in the brilliant Fin$mart 2026 Faceoff hosted by Money Matters BVI and BVI Finance. The competition was fierce, but a good time was had by all.

O’Neal Webster was pleased to sponsor the FIRST PLACE PRIZE WINNING SCHOOL. Partner Jenelle Archer presented the prize to CLAUDIA CREQUE EDUCATIONAL CENTRE, ANEGADA!

Claudia Creque Educational Centre student representatives Amiah Chang & Alex Varlack wagered $2,000 in the final jeopardy round and it paid off! Amiah was also awarded the MVP prize for the whole competition! Congratulations all!

2nd Place honors went to Robinson O’Neal Memorial Primary Division, Virgin Gorda

3rd Place honors went to Agape Total Life Academy, Tortola

Rounding out the competitors were Tortola schools Enis Adams Primary School, Joyce Samules Primary School and Willard Wheatley Primary School.

O’Neal Webster’s Litigation Department Welcomes Koya Ryan, Associate Attorney

O’Neal Webster is pleased to announce that Koya Ryan has joined the firm as an associate attorney in the litigation department. Her practice covers civil, commercial, insolvency, and cross-border disputes. She is admitted to practice in the British Virgin Islands and Trinidad and Tobago.

Koya brings experience in judicial research and analysis from her work as Judicial Research Counsel to judges of the High Court and Court of Appeal in Trinidad and Tobago, where she assisted on matters involving civil and commercial issues, including insolvency, arbitration, property, family, constitutional, and public law.

“We are pleased to welcome Koya to the firm. Her unique experience of working closely with both High Court and Court of Appeal judges will be an asset to the team and by extension our clients,” Vanessa King, O’Neal Webster Managing Partner, commented.

Koya holds an LLM in International Dispute Resolution (Merit) from Queen Mary University of London, a Legal Education Certificate from the Eugene Dupuch Law School, an LLB from the University of London, and a BSc in Economics and International Relations from the University of the West Indies. She has earned several academic awards, including Council Prizes and distinctions from the Eugene Dupuch Law School for academic performance.

Learn more here: Koya Ryan

BVI Approved Managers – Managing Investments Globally

In 2023, it was estimated that the value of assets under management by hedge funds was in the region of US $5 trillion. Increasingly, offshore jurisdictions such as the British Virgin Islands (BVI) feature in the structures used by onshore and offshore investment managers to cater for a growing and diverse cross section of investors, including newly minted fintech millionaires and billionaires. The BVI is the world’s largest offshore corporate domicile with over 350,000 active companies, and it is also the world’s second-largest offshore investment funds domicile with close to 2,000 investment funds.

Twenty Tips and Tricks for BVI Trustees and Registered Agents – Part Four

The following is the fourth and final part of the very popular series written by Chris McKenzie. Topics covered in Part Four:

- Sixteen: The need to take care when schedules are included in trust instruments

- Seventeen: Default provisions conferring discretion on trustees

- Eighteen: The need for VISTA-compatible memoranda and articles

- Nineteen: Provisions to the effect that beneficiaries of discretionary trusts are entitled to specified fractions of the trust fund

- Twenty: The inadvisability of holding the shares in a PTC in the name of the settlor

BVI Statutory Mergers: A valuable tool for business combinations and restructurings globally

The BVI statutory merger process is recognized globally and has been used effectively for many years.

However, today, more global entities increasingly use BVI statutory mergers in high-value cross-border transactions. This shift substantiates the BVI’s corporate regime, which is valued for its ample flexibility in facilitating cross-border business combinations and restructurings, supporting the evolution of businesses over time.

The statutory nature of the BVI merger process provides certainty regarding the exchange of shares, other securities, assets and liabilities, which are critical elements in most business combinations and restructurings. As such, the BVI remains an essential jurisdiction in the mergers and acquisitions market for small, medium and global players. To learn more about how BVI statutory mergers work, link here.